One of the best pieces I ever came across was entitled,

As you know I do a fair bit of bonds for my retail clients, so this piece was very interesting to me.. so - I set about to recreate Paul's work..

First, to make sure I had the right idea - I recreated Paul's graph from 1983 to 2005, just to make sure it looked similar.

not bad..

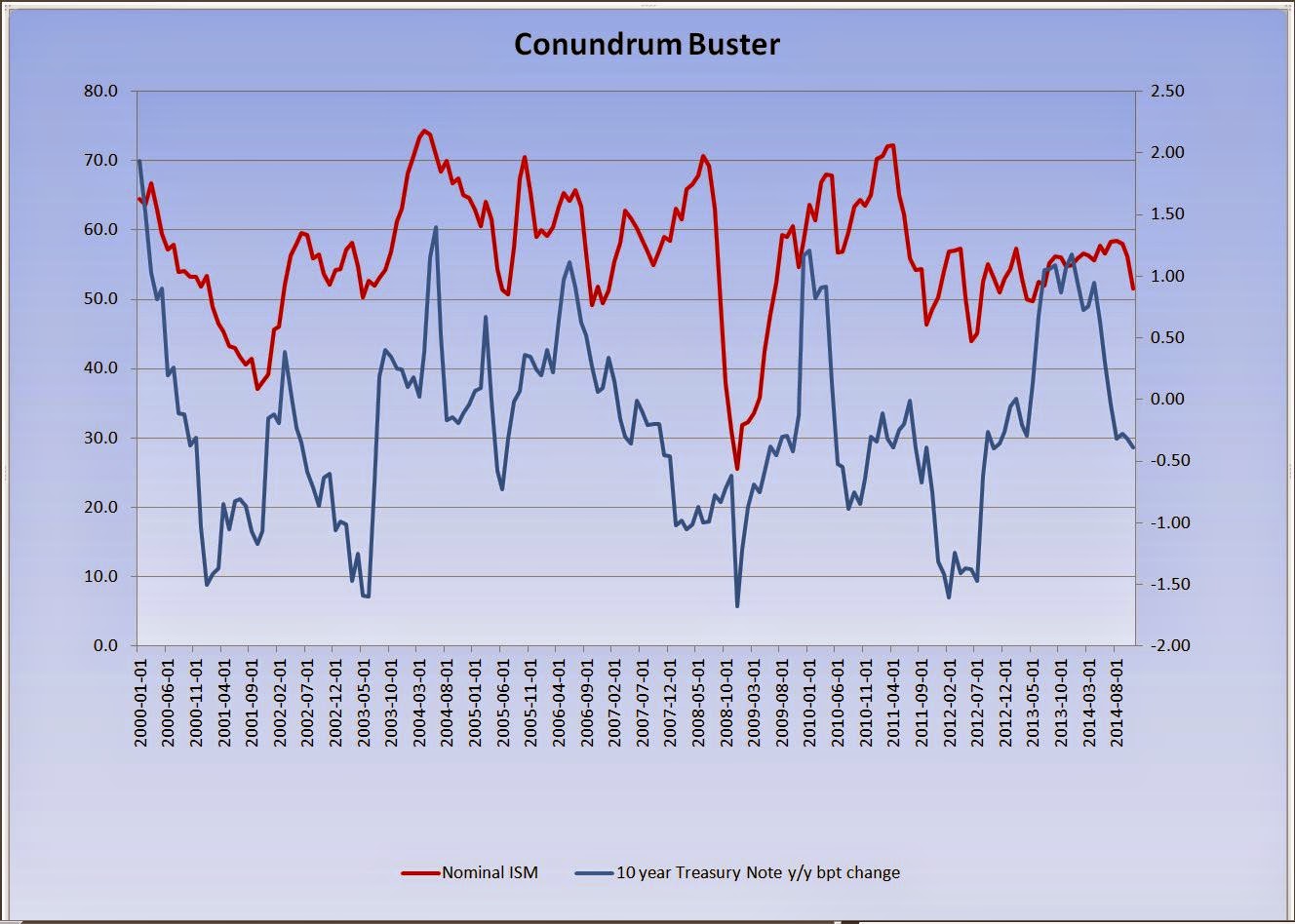

and then, I went off and applied the same set of rules to today's market. I've done this a few times (after the taper tantrum for example.. to check and see what I was missing) -

here's where we are today -

so to me, this continues to flash the "all clear" on rates. As such I don't think you will see rates rise because of fundamentals. We could however see a rate bump as per Gundlach's suggestions - but I doubt it would be much, or meaningful.. as the data just doesn't support a move higher at this point.

Interesting stuff -

No comments:

Post a Comment